Three hours of researching the sea of life insurance options left Robert feeling a bit crazy. Usually, he’d choose a basic policy for himself, but with a baby on the way, finding comprehensive coverage had become crucial. He was about to close his laptop in frustration when a small chat window popped up in the corner of the insurance company’s website.

“Hi, I am Alex, your AI assistant. Need help finding the right life insurance policy?

Robert stopped for a second. He knew that the use of AI had become a trend, but he never expected it in such a personal area as life insurance. Curiosity got him, and he continued interacting with the chatbot.

The AI assistant asked Robert about Robert’s lifestyle, family plans, and budget targets. It promptly reviewed thousands of policies, presenting custom-made options in minutes. The bot also explained unclear terminology, so Robert got the impression that he was texting with a savvy buddy rather than a faceless corporation.

This story is not a fairy tale anymore; it’s our reality. The use of AI in the insurance industry is embracing more companies. In this post, we’re going to look at what AI and Gen AI can do and how these tech tools are making life simpler for both insurance customers and the companies that serve them.

The Rubyroid Labs development team is here to accurately integrate artificial intelligence technologies into your business. We can embed AI APIs into your insurance platform, create a chatbot, or develop AI-based pricing engines for more correct and dynamic calculations. Get in touch with us for a detailed estimate of an AI solution customized to your business needs and designed to elevate your productivity.

Contents

- Challenges in the Traditional Insurance Sectors

- Top 3 Technologies of AI in the Insurance Industry

- Benefits and Risks of Using AI for Insurers

- Case studies: AI Chatbot Development for Insurance Database

- What’s the Future of Integrating AI in Insurance Industry?

- Final Thoughts

Challenges in the Traditional Insurance Sector

The convenience of texting agents and buying insurance online has made physical visits to insurance companies largely unnecessary. Insurers are aware of this shift in consumer behavior.

However, while forward-thinking companies are adopting artificial intelligence into their operations, more conservative firms still rely on traditional methods. So, the business owners are facing significant difficulties in customer communication, service delivery, data analysis, pricing strategies, and personal data protection.

Let’s examine typical challenges that confront company owners through real-life examples.

Changing Customer Needs

The case

Helen, a freelance graphic designer, is planning a three-month work trip abroad. She calls her insurance agent to update her health coverage and insure her rather expensive camera. However, Helen faces difficulties: during the conversation, she has to wait a long time and receives unclear explanations about the policy changes. To make matters worse, the agent is unable to offer a customized insurance plan, as Helen can only get an international coverage policy, and a separate in-person visit is required for equipment insurance.

What’s the problem?

- Insurance companies fail to adapt to specific customer requirements and instead provide one-size-fits-all solutions, which leaves customers disappointed. This unhappiness prompts clients to look into alternative insurance providers that may offer more tailored services.

- Excessive manual work hinders managers, and they cannot process claims faster and interact with their clients more attentively.

Solution

Implementing AI-powered solutions for repetitive operations can significantly reduce the stress on insurance managers. By establishing and training an intelligent software system to handle customer requests, the claims processing schedule may be greatly streamlined. So the whole team can work more effectively.

Data Overload and Analysis

The case

GlobalCare Insurance deals with millions of policies, claims, and customer records each year. As the business grows, the company’s employees find themselves buried under a massive volume of data. Moreover, agents spend ages finding necessary client information, manually uncovering customer profiles, personal details, and claim histories.

Additionally, the lack of effective tools has made doing risk assessments and identifying fraud more challenging.

What’s the problem?

The insurer faces inefficiency in risk assessment, pricing, and fraud detection because of the absence of modern tools that could analyze this data. As the company cannot process that data in real-time, it misses the opportunity to be more competitive. They cannot offer personalized policies or detect fraud before payouts are made.

Solution

Advanced artificial intelligence and machine learning tools can help the company analyze massive sets of data promptly. When an AI model is trained on historical data, it can predict consumer requirements, optimize pricing models, and spot fraud tendencies faster than human teams ever could. By using AI-powered data analytics, it is possible to improve decision-making and create personalized insurance policies, resulting in higher client happiness and profitability.

Cybersecurity Issues

The case

Everest Insurance experienced a significant cybersecurity breach in 2023 when hackers exploited a vulnerability in their client interface. The incident began with a phishing email and exposed confidential data of approximately 200,000 clients, including names, addresses, and social security numbers. Secure Shield’s reputation suffered a significant blow, resulting in a 15% decline in insurance renewals and probable litigation.

What’s the problem?

Each year, cybercriminals create more sophisticated ways of attacking the vulnerabilities in insurance systems and stealing the information, which may result in hard financial and reputational losses.

Solution

The use of artificial intelligence in cybersecurity can significantly help with preventing cyberattacks. As a solution, it’s possible to use either cloud-based solutions like OpenAI or Claude, or create local AI models for data processing and analysis.

Custom in-house AI models may analyze sensitive data in their own safe settings, dramatically lowering the risk of data breaches during transfer or storage on external servers. This strategy enables insurers to use powerful AI capabilities for fraud detection, risk assessment, and customer service while keeping complete control over their data.

Unpredicted Climate Changes

The case

ABC Assurance, a leading insurance provider in the western United States, faced a crisis as a result of growing weather-related incidents. California had its worst wildfire season on record, while Oregon and Washington had historic floods. These disasters prompted a rise in claims, bringing PCA’s payments to $3.5 billion, nearly double their previous yearly record.

What’s the problem?

Extreme weather events are becoming more frequent and intense, posing significant difficulties to insurers. As payouts for climate-related claims rise, insurance providers are under increasing pressure to review their risk models and change their pricing methods.

Solution

To stay ahead, insurers must innovate. Implementing AI in the insurance industry across domains such as predictive maintenance, dynamic pricing, and advanced risk modeling may help prevent certain companies’ losses and foster user loyalty.

These examples show how integrating GenAI or AI can help overcome challenges of traditional operations.

With artificial intelligence, you can catch two birds with one net: AI can help meet user needs and accelerate the key business processes, such as claim processing, underwriting, customer service, and fraud detection. The result: more profit, streamlined operations, and enhanced company’s prestige.

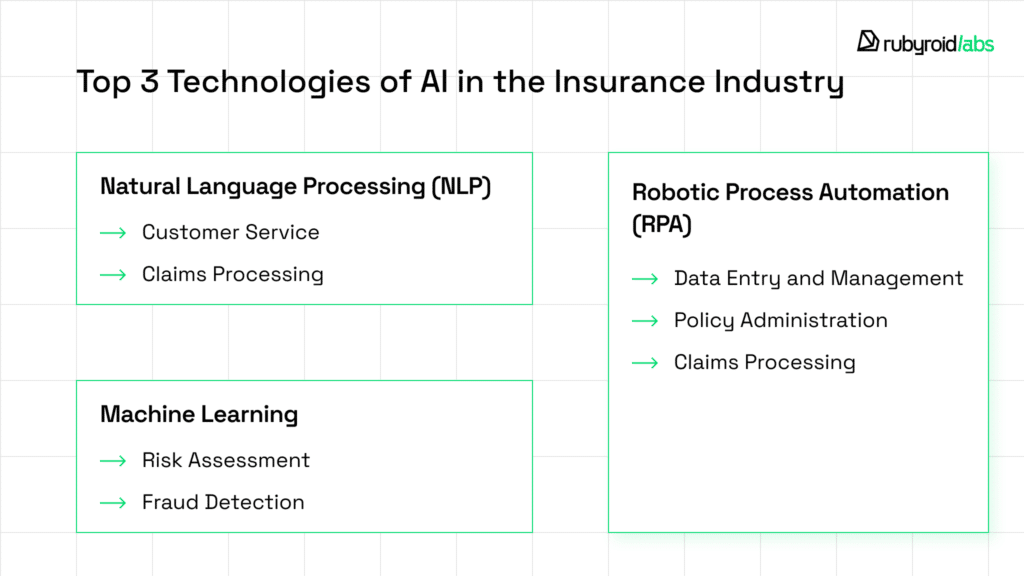

Top 3 Technologies of AI in the Insurance Industry

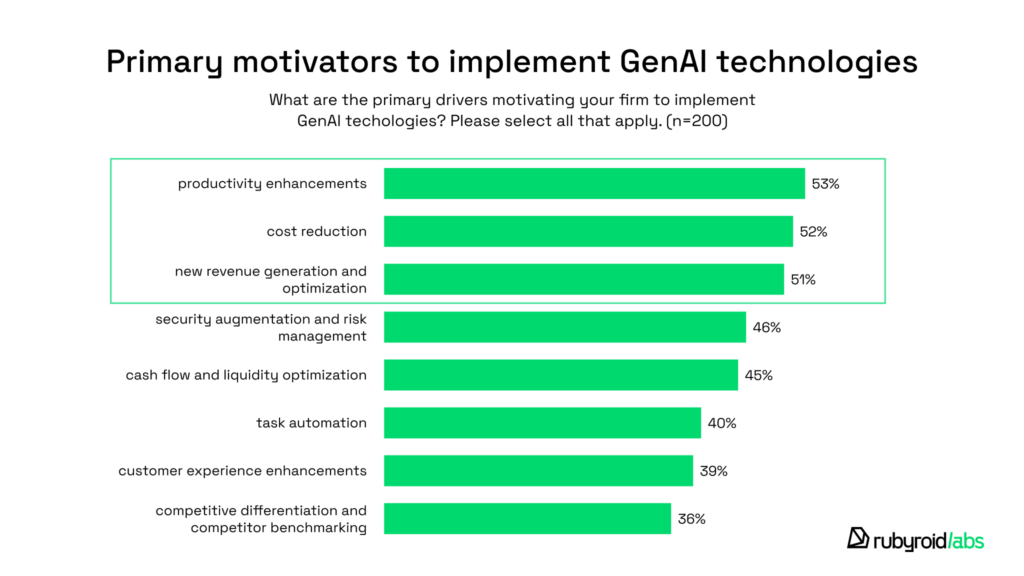

Depending on the goals you are following, the purposes of using AI can be unlimited. According to the EY-Parthenon survey, the top reasons that motivate companies to implement AI are productivity enhancement, cost reduction, and new revenue generation and optimization.

Among various AI technologies, three stand out for their effectiveness: machine learning, natural language processing, and robotic process automation.

Machine Learning

Machine learning (ML) is about getting computers to figure things out by themselves, kind of like how people learn from trying things out. Instead of being distinctly coded for each case, machines are taught on data to identify patterns.

| Example: An insurance company uses machine learning to assess risk and determine car insurance prices. It’s similar to having an expert who can swiftly evaluate hundreds of driving records and accident reports. The system uses past claim data, driving patterns, and other characteristics to properly forecast the possibility of a claim and recommend suitable rates. |

The use of machine learning lies in assessing risks and flagging potentially dishonest claims.

Risk Assessment

Artificial intelligence algorithms scan through enormous data sets to predict possible dangers with impressive accuracy. This capacity enables insurers to:

- Create finely-tuned pricing methods that fit with each customer’s unique risk factors.

- Pinpoint clients or behaviors that carry heightened risks.

- Modify premium rates in real-time, reacting to the most recent available data.

Fraud Detection

Harnessing ML, artificial intelligence identifies signals of potential deception:

- Examine previous claim records to identify questionable tendencies.

- Instantly identify assertions that trigger red flags.

- Reduce inaccurate suspicions, streamline investigation efforts, and conserve resources.

Natural Language Processing (NLP)

NLP is an area of artificial intelligence that allows bots to understand, interpret, and generate human speech and text. It’s analogous to teaching computers to grasp, process, and reply in our languages, duplicating human linguistic talents.

| Example: When you interact with a customer service chatbot on a website, NLP helps the bot understand your questions and provide relevant answers. It’s like having a customer service manager who can instantly understand and respond to a wide range of queries. |

The artificial intelligence can scan through a vast database and match a client with the best insurance plan in a few seconds. This capability is especially important for companies with a variety of complex insurance plans available. The AI swiftly analyzes all options, simplifying what would otherwise be an overwhelming process.

In the insurance sector, NLP technology boosts customer interactions and expedites claim handling procedures.

Customer Service

Natural language processing fuels smart digital helpers and AI-driven chat systems, facilitating:

- Round-the-clock assistance for policy-related questions.

- Swift, automated replies to common inquiries.

- Seamless transfer of intricate issues to human specialists.

Claims Processing

NLP speeds up claim handling by:

- Automatically extracting key information from claim documents.

- Assessing client mood in messages to expedite critical cases.

- Quickly classifying and directing claims to the appropriate teams.

Robotic Process Automation (RPA)

RPA is another artificial intelligence technology that enables computers to simulate human actions to carry out repetitive, rules-driven tasks automatically. You can think of RPA as a virtual employee that interacts with software applications just like a person, but at a faster pace and without the risk of burnout or errors.

| Example: Regular reports need to be created by gathering data from various sources. RPA can automate this process, collecting the necessary data and compiling it into a report. It’s like having a diligent analyst who can quickly pull together reports whenever needed. |

Implementing robotic process automation makes it possible to automate repetitive tasks and significantly improve operational efficiency.

Data Entry and Management

RPA bots can:

- Input data from various sources into core systems accurately and quickly

- Validate and cross-check information across multiple databases

- Update policyholder information automatically

Policy Administration

RPA streamlines policy-related tasks such as:

- Automating policy renewals and cancellations

- Generating and sending policy documents to customers

- Processing simple policy changes without human intervention

Claims Processing

RPA contributes to faster claims processing by:

- Automating initial claims intake and categorization

- Expediting simple, straightforward claims

- Coordinating with other systems to gather necessary information for complex claims

These three AI technologies can change the way your insurance company operates, increasing the entire productivity several times.

Apart from that, the integration of artificial intelligence will enhance accuracy in risk assessment, improve customer interactions, streamline claim processing, and boost overall operational efficiency.

As these technologies continue to evolve, they promise to make insurance more personalized, responsive, and cost-effective.

At Rubyroid Labs, we are ready to provide ChatGPT integration services for your project, discussing every tiny detail and your goals and requirements.

We have experience in various industries, including health and fitness, sports, and insurance. Our developers are highly skilled at adapting ChatGPT, Gemini, Claude, Llama or Whisper technologies to diverse business contexts and can help realize your ideas effectively.

Whether you’re looking to enhance customer service, automate processes, or create innovative AI-driven solutions, we’re ready to discuss how artificial intelligence integration can benefit your project. Contact us to explore the possibilities for your business.

Benefits and Risks of Using AI for Insurers

| Benefit | Explanation | Example |

| Efficient processing of insurance requests | Artificial intelligence quickly digests claim details, shortening the overall processing period. | Sarah’s car was damaged in a minor accident. She submitted photos through her insurer’s app, and AI assessed the damage within minutes, approving her claim for repairs without human involvement. |

| Upgraded fraud recognition | AI algorithms can recognize red flags that humans might miss. | John tried to file a false claim for a “stolen” laptop. The artificial intelligence flagged inconsistencies in his story and past claim history, prompting a deeper investigation that uncovered the fraud attempt. |

| Personalized pricing | AI-powered systems crunch massive quantities of data, yielding customized and more exact premium calculations. | Maria, a safe driver with a clean record, received a lower car insurance quote thanks to AI analysis of her driving habits through a telematics device. |

| Upgraded customer assistance | The chatbots fueled by AI tackle basic concerns day and night, minimizing wait times. | Tom had a question about his policy at 2 AM. He got an immediate answer from the insurance company’s AI chatbot, without having to wait for business hours. |

| Forecasting potential risks | Artificial intelligence examines datasets and anticipates potential threats more reliably. | An AI system examined meteorological data and property records, warning inhabitants of flood-risk areas to implement safeguards before a significant downpour. |

The Risks of Using Artificial Intelligence In Insurance Industry

Implementing AI in insurance brings both opportunities and risks. Before adopting this technology in your company, it’s important to weigh the potential pitfalls. We enumerate the most essential of them:

| Risk | Explanation | Example |

| Digital privacy threats | Artificial intelligence requires large sets of personal data, raising privacy issues. | Some customers were uncomfortable with their home insurance company using AI to analyze their smart home device data for risk assessment. |

| Algorithmic bias | AI systems might inadvertently discriminate based on protected characteristics. | An AI system was found to be offering higher premiums to residents of certain zip codes, which correlated with race, leading to accusations of discrimination. |

| Lack of transparency | Some AI decision mechanisms can be hard to explain, creating a “black box” problem. | When Jake was denied coverage, he couldn’t get a clear explanation of why the AI system made that decision, leading to frustration and distrust. |

| Cybersecurity risks | Poorly trained AI systems could be vulnerable to hacking or manipulation. | Hackers targeted an insurance company’s AI system, attempting to manipulate risk assessments to obtain lower premiums fraudulently |

| Overreliance on technology | Excessive dependence on AI could lead to overlooking human judgment in complex cases. | An AI system approved a complex business insurance claim without considering unique factors that a human underwriter would have flagged for further review |

By understanding these benefits and risks, insurance companies can work to maximize the advantages of AI while mitigating potential downsides through careful implementation and oversight.

Preventing many of these risks depends heavily on the professionalism of the development team, which is crucial in training AI, chatbot development, and scripting the algorithms. A skilled team can design AI systems with built-in safeguards, fairness, and clarity. They can also combine the benefits of automated processes with the needed human control.

Case studies: AI Chatbot Development for Insurance Database

Remember Robert, the guy who was looking for an insurance policy and encountered an AI chatbot? We have a similar real story showing the process from another side—how the company owner found the solution in AI integration and solved the problems of their business.

CoverageExpert is a comprehensive US insurance database that contains over 700 policy forms and 33,000+ coverage enhancements from top insurers. The platform serves as a crucial resource for insurance professionals, brokers, and analysts who need quick access to detailed policy information and coverage comparisons.

Challenge:

Despite having a vast and valuable database, CoverageExpert faced challenges in making this information easily accessible and actionable for its users. The client addressed us with the goal of leveraging AI technologies to enhance data accessibility, improve user experience, and provide more sophisticated analysis tools.

Our Services:

ChatGPT Integration:

We developed a chatbot powered by ChatGPT to provide quick and relevant information about insurance products based on CoverageExpert’s proprietary database.

Key features:

- Natural language processing to understand user queries

- Contextual understanding to provide accurate policy information

- Ability to compare different policies and highlight key differences

- Quick access to specific coverage details and enhancements

Benefits:

- Reduced time for users to find relevant information

- Improved user engagement and satisfaction

- Decreased workload for customer support team

Gemini Integration:

We implemented a Gemini-based tool to assist in identifying potential coverage improvements that might be overlooked in the standard insurance coverage review process.

Key features:

- Advanced pattern recognition to identify coverage gaps

- Comparison of client policies with industry best practices

- Suggestion of relevant coverage enhancements

- Generation of detailed reports highlighting potential improvements

Benefits:

- More comprehensive coverage reviews

- Identification of previously overlooked opportunities for improved coverage

- Enhanced value proposition for CoverageExpert’s clients

As a result, the client improved the efficiency of business processes, reduced the time spent searching for specific policy information, and increased user engagement on the platform.

Inspiring, isn’t it? If you want to consult with us on your project, reach out to us right away. We can help you choose the right AI technology and prepare the estimate of the project.

What’s the Future of Integrating AI in the Insurance Industry?

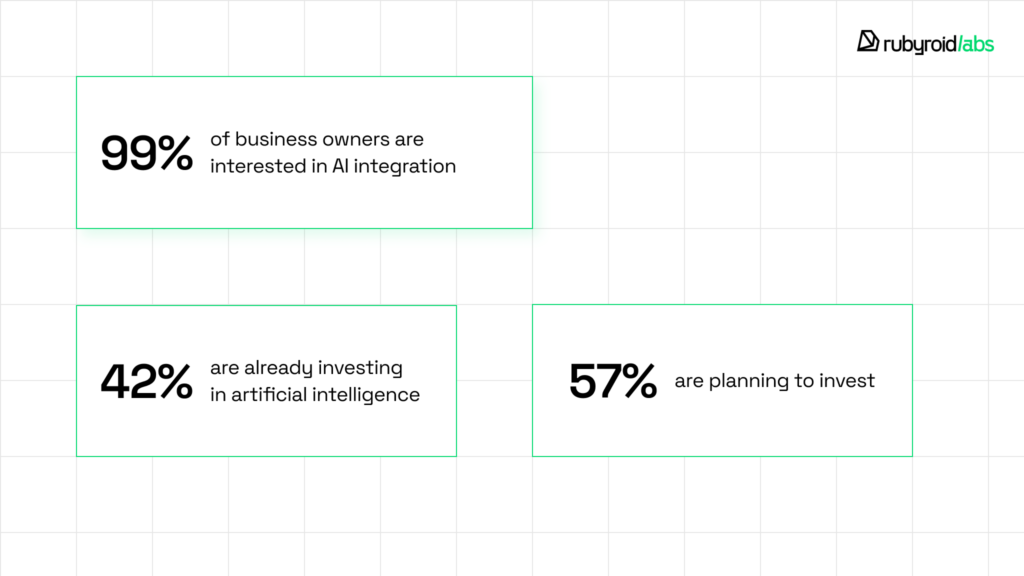

The use of AI and generative AI in the insurance industry will spread further among insurers worldwide. As the EY study of 200 senior insurance decision-makers shows, 99% of business owners are interested in integrating AI. At the same time, 42% of them are already investing in artificial intelligence, and 57% are planning to invest.

We asked our AI developer, Ilya, about his vision of the future of smart assistants:

In the future, we can expect AI assistants to become even more sophisticated, handling complex inquiries and providing individualized recommendations. They will most likely interface with several data sources to provide real-time policy modifications and risk assessments. Furthermore, artificial intelligence will continue to play an important role in fraud detection and claim processing, making them faster and more accurate. Finally, this will lead to more efficient operations for insurers and a more seamless, personalized experience for customers. The key will be finding the correct balance between AI capabilities and human knowledge in order to give the best possible service.

Final Thoughts

Adopting AI isn’t a fleeting trend; it’s only a matter of time before insurers adopt it fully. Artificial intelligence technology may help you accelerate business processes, protect internal data, improve customer relationships, and become flexible overall. These enhancements will bring numerous advantages, including improved consumer trust, a better reputation, and higher revenue.

If you’re seeking to develop an AI tool for your insurance project, the Rubyroid Labs team will assist you. Get in touch with us! Our expert team will walk you through every step of the process, from identifying your ideas and requirements to developing a customized AI solution to match your unique needs. We’ll work directly with you to ensure that the final product completely matches with your company’s objectives and improves operational efficiency.