Scaling a crypto app with 800+ APIs

- Multiple integration services

- Debugging

- Issue resolution

- Maintenance

Koinly is a powerful cryptocurrency tax reporting and portfolio tracking platform that helps simplify the complex process of crypto tax compliance. It automatically imports transaction data from over 800 exchanges, wallets, and blockchains, calculates capital gains and losses, and generates ready-to-file tax reports tailored to local tax laws across multiple jurisdictions. The platform operates in more than 20 countries, helping users save time and ensure accurate tax reporting.

december 2021 -

august 2024

UK, London

fintech, cryptocurrency

- 4 Ruby on Rails developers

-

20%

increase in tax calculation accuracy

-

Improved

platform stability with 800+ integrations

-

25%

reduction in user drop-off

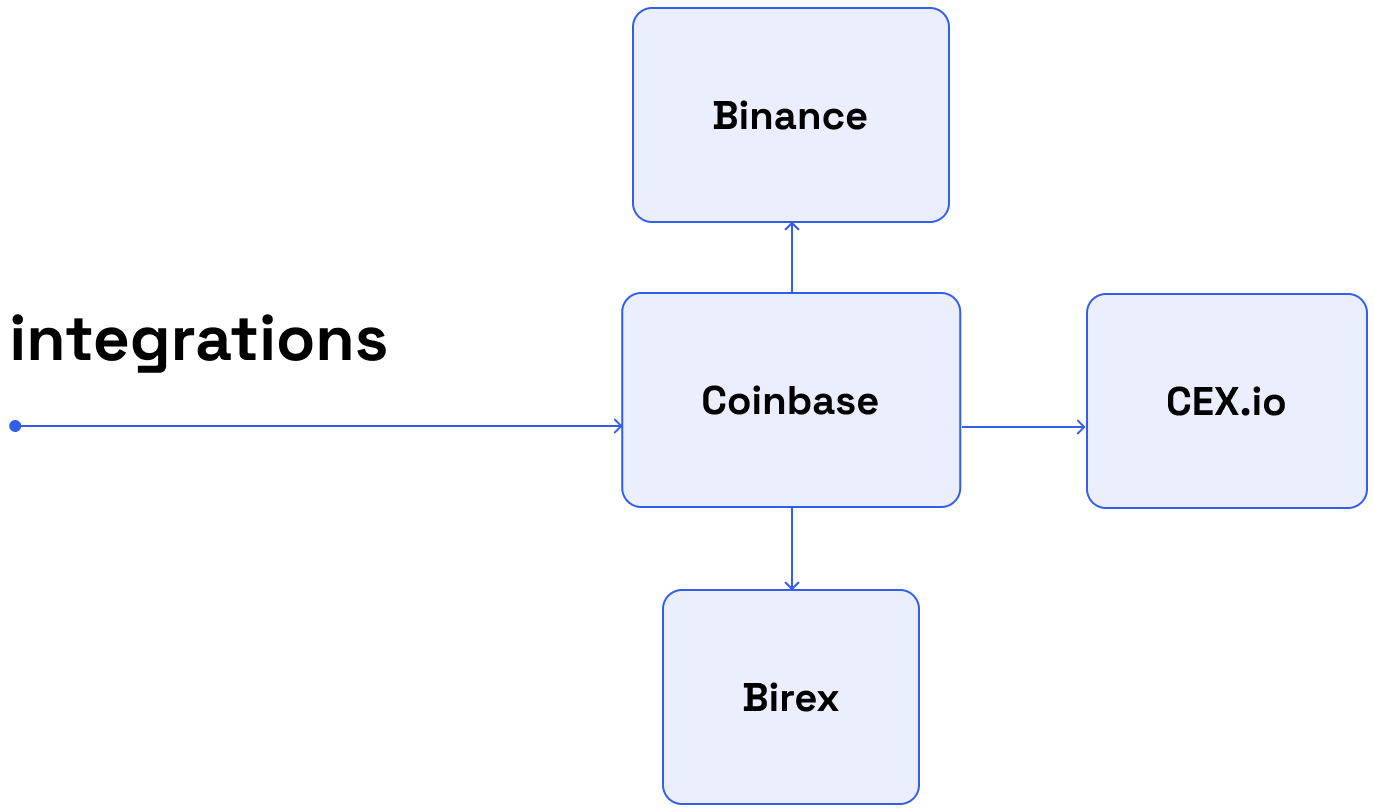

The client faced increasing challenges as the crypto ecosystem rapidly evolved. New exchanges, blockchains, and financial products were launching almost every day, and users expected quick integration to report their income accurately and stay tax-compliant.

Falling behind on these integrations posed a serious risk to the business, leading to potential customer churn, loss of trust, and compliance issues. That’s why building and maintaining a reliable, scalable integration system became a top priority.

This meant not only adding support for new platforms, but also keeping up with frequent API and data format changes from major players like Binance, Coinbase, Bybit, and OKX.

third-party integrations

To ensure full data coverage across all platforms, regardless of their technical limitations, we developed support for both API-based and file-based integrations.

When platforms offered reliable public APIs, we built automated pipelines using Ruby on Rails to ensure accurate and timely data imports. Where APIs were missing or incomplete, we developed robust CSV parsers capable of handling messy formats and edge cases.

This flexible integration model allowed us to support a wide range of platforms and guarantee accurate income reporting for every user.

platform maintenance

With dozens of complex integrations and more coming, we needed to keep the system stable and make future integrations easy to add. This required a reliable codebase, as even small bugs could cause broken imports, bad data, or compliance issues.

We introduced a rigorous peer review process for all integration-related code, checking each update for accuracy, performance, and consistency.

This helped us maintain a stable, scalable platform that kept pace with the fast-changing crypto ecosystem.

delivered features

- integrated major crypto APIs for real-time data and seamless platform connectivity

- normalized exchange CSVs for accurate transaction tracking

- upgraded architecture to support fast integration of new crypto platforms

- optimized transaction flows, boosting crypto operations accuracy and reporting by 20%

- created clear specifications and documentation to speed up development and reduce errors

- performed code audits to identify bugs early, ensure code quality, and maintain system reliability

technology stack

Backend

Ruby Ruby on Rails Redis

Other

Rspec Jira Rollbar

communication

Throughout the project, we maintained communication via Jira and Slack, ensuring alignment on tasks and progress. This supported an efficient, asynchronous workflow that kept the team coordinated.

result

Our work significantly expanded the

application’s

integration capabilities, enabling seamless and up-to-date data synchronization with major

exchanges and wallets. This improved the accuracy of tax calculations by 20%, enhanced platform

stability, and reduced user drop-off by 25%.

Users can now quickly declare income from dozens of new exchanges and blockchains, many of which are uniquely supported compared to competitors.

Estimate your project

Please fill out this form, and our manager will contact you within one business hour. If necessary, we can sign an NDA and begin project discussions.

Thank you.

Your message has been sent successfully!

We’ll get in touch with you within 24 hours, excepting requests received on Saturday, Sunday.